Ever wonder how some investors magically make money in the stock market or crypto exchanges? The secret might just be smart tools called AI trading bots.

Now, let’s dive into AI trading bots. We’ll understand how they work and check out some of the best ones out there.

Table of Contents

What is an AI Trading Bot?

An AI trading bot is a smart software that automatically trades stuff like stocks, crypto, forex, and commodities. It uses clever algorithms to make those trades happen.

Here’s what makes them tick:

- Data Analysis: These bots dive into heaps of market data on the fly, picking up on past trends to guess where the market might head next.

- Decision Making: Thanks to AI, these bots can decode tricky patterns and make trading calls on their own or with a little help from humans.

- Execution: Once they’ve made up their minds, they jump in and trade at just the right moments, sometimes in the blink of an eye if the stars align.

How Do AI Trading Bots Work?

Imagine a super-smart assistant watching the markets 24/7, learning, and trading on your behalf. Here’s how:

1. Data Collection

AI bots scoop up data from all sorts of places—price feeds, trading volumes, economic indicators, news, and even social media vibes.

Then, they tidy up this data and get it ready for analysis.

2. Machine Learning and AI Algorithms

- Machine Learning: AI trading bots use cool stuff like deep learning, regression models, pattern recognition, and time series whiz to get a handle on market trends.

- Predictive Modeling: The bot cooks up models to forecast where prices might head by looking at past data and what’s happening in the market right now.

3. Strategy Formation

Based on the predictions, the bot comes up with trading strategies. These could be:

Trend Following: Riding the wave of ongoing trends.

Mean Reversion: Wagering on prices bouncing back to their average.

Arbitrage: Taking advantage of price gaps across different markets or exchanges.

4. Risk Management

A good AI trading bot manages risk by setting limits on trades, employing stop-loss orders, and adjusting positions based on volatility and market conditions.

5. Execution

When the strategy’s conditions are just right, the bot jumps into action. It places buy or sell orders through connected trading platforms or APIs.

It’s as simple as that!

Best AI Trading Bots in 2025

Here’s a look at some of the top AI trading bots that have garnered attention for their functionality and success rate:

1. Cryptohopper

Cryptohopper is popular because it’s easy to use, especially for beginners. It works with multiple exchanges, so you can manage your portfolios all from one place.

You get loads of cool features like customizable strategy templates and signal trading. It even connects with external signal providers like TradingView and has backtesting capabilities.

The community is awesome!

You can share strategies, join discussions, and learn from others. It’s the perfect spot for collaboration.

- Ideal for: Crypto enthusiasts who want a customizable bot. This one lets you share strategies with the community.

2. TradeSanta

TradeSanta is awesome because it supports both DCA (Dollar Cost Averaging) and Grid Trading strategies. You can adjust your trades for long-term or short-term goals.

It works smoothly with big exchanges like Binance and Bittrex. Plus, they’ve got 24/7 support, which is super handy in the fast-moving crypto world. They also provide detailed analytics to fine-tune your trading strategies.

Best for: Folks who want to dive into automated crypto trading with a focus on long-term investments.

3. Pionex

Pionex stands out by integrating trading bots directly into their exchange platform. There’s no need for extra setup, making it super easy for users to trade with bots.

Some trading pairs even have zero fees. You’ll find advanced charting tools and various strategies like Grid Trading, Trailing Stop, and leveraged trading.

The platform’s automated trading is perfect for those who don’t want to constantly watch the markets.

Best for: Traders who want a platform with built-in bots and a competitive edge in the crypto space.

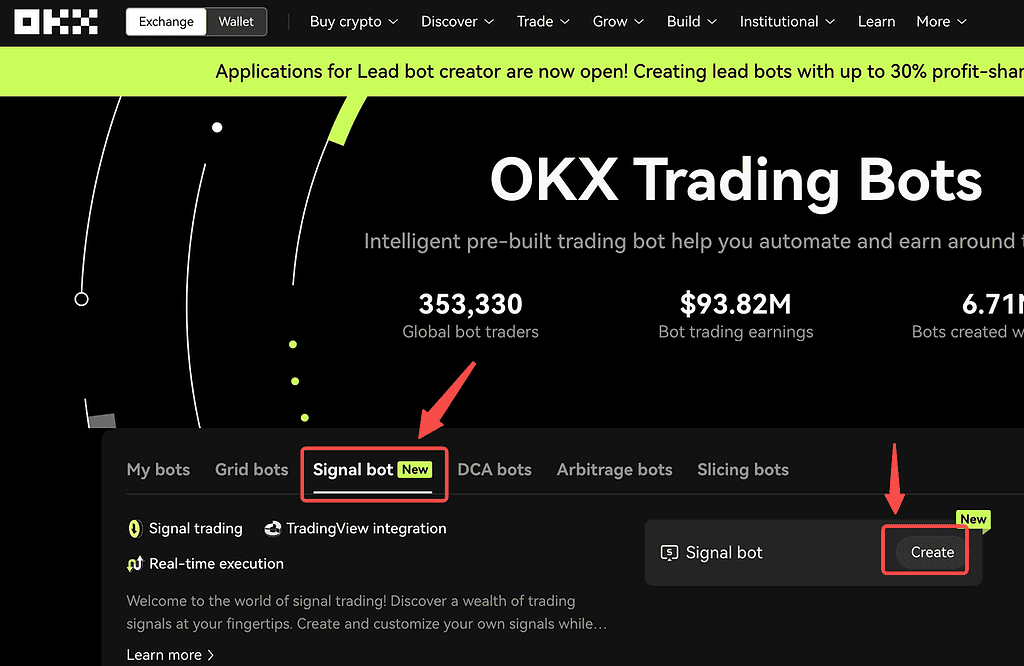

4. OKX Trading Bot

OKX’s trading bot is super easy to use and fits right into the platform. It offers different strategies like DCA, Grid Trading, and Futures Grid. You can use it for both short-term and long-term trading.

It lets you customize the settings for managing risk. You can test your strategies with backtesting and live testing options.

Plus, it gives access to multiple markets and has a friendly user interface. You can trade 24/7, which is awesome for anyone looking to automate with flexibility and control.

Best for: Developers and traders who want to tweak and personalize their trading strategies.

5. 3Commas

3Commas is packed with tools for traders. Its automation is top-notch, featuring SmartTrade for intricate orders and Trailing Take Profit to boost gains while cutting down on risks.

It syncs with TradingView for signals and has cool social trading options. This makes it ideal for copying winning strategies or getting tips from expert analysts.

Best for: Pro traders who crave advanced automation and social trading perks.

Pros of AI Trading Bots:

- Trading bots are on the clock 24/7. They catch market opportunities even when humans can’t.

- Bots trade at lightning speed, often quicker than any human. No feelings involved.

- AI trading cuts out the emotion, so no panic selling or overconfident moves here.

- They stick to the plan. Bots follow the rules, keeping your trading strategies consistent.

- Plus, advanced risk management tools like stop-losses have got your back against potential losses.

Cons of AI Trading Bots:

- Setting up a bot to fit your strategy ain’t always a walk in the park. You need to know your stuff.

- When you over-optimize, you might just be setting yourself up for failure, because past success doesn’t guarantee future results.

- Markets can throw curveballs out of nowhere, and bots aren’t always quick on their feet.

- They rely heavily on old data to spot new trends, but that might bomb when the market flips the script.

- Plus, these bots need a solid internet connection and a stable platform to work their magic, which can be tricky sometimes.

Conclusion

AI trading bots are a big step forward in trading tech. They bring automation, speed, and data analysis that’s beyond human reach. But they come with risks. Their complexity means you need to understand how they work and align them with your goals. Keep in mind:

Risk Management: Use stop losses, diversify, and set realistic expectations.

Backtesting: Try strategies on past data before going live.

Stay Informed: Markets change, and your strategies should too.

If you’re thinking about AI trading, learn the ropes, start small, and remember there are risks. With the right bot and a smart strategy, you could make some standout trades too.

Remember, success in trading isn’t guaranteed.