Should I rent or buy a house in 2025? As the housing market remains dynamic, inflation steadily rises, and we are met with fluctuating mortgage rates, everybody keeps asking this question.

As of now, approximately 65.9% of individuals in the United States are homeowners.

But increasingly, especially among younger generations, more people choose to rent because it is less expensive in many cases.

Table of Contents

So, here’s the million-dollar question: Is it better to rent — or should you go all in and buy a house? Such a decision is no longer as simple as it once was.

To some, a home acts as both stability and a long-term investment. For others, it allows for financial flexibility and freedom.

The stakes are high. A bad decision can sink you thousands of dollars — or even your sanity. In this guide, we’ll look at the pros and cons, discuss financial tools such as rent vs. buy calculators, and list the factors you should consider when making one of the most important decisions of your life.

By the time you reach the end of the article, you’ll have a sound idea on whether renting or owning a home is what best fits you in 2025.

Finally, Let’s Put “Renting vs. Buying” Debate To Rest

Why Does the Renting vs Buying Decision Matter So Much in 2025?

Five years ago, the housing scene looked different. It’s a whirlwind. Interest rates have increased, rents continue to rise and the cost of living appears to go up each time you blink.

That’s why deciding whether to buy a house or rent matters now more than ever.

Here’s why it matters:

- The decision you make here will impact the rest of your financial future. Your choice could mean saving or losing thousands.

- Consider lifestyle options. Do you value your ability to move, or are you ready to stop and go for a while?

- Think long-term about building wealth. Buying a home has traditionally been considered an investment, but is that still true now?

- You develop a sentiment about the market. In an economically uncertain news cycle, it’s hard to say which will of provide the best service in the long run.

Whether you’re a first-time buyer or reconsidering your current housing situation, it’s important to have the complete picture.

So, let us examine the dynamics of purchasing vs. renting a house.

Renting Home in 2025

Renting isn’t only for people who can’t afford to buy. Indeed, renting has unique benefits that merit consideration, even in an unpredictable economy like 2025.

1. Flexibility to Adapt

Life’s full of changes. Jobs change, relationships evolve and sometimes we simply need a fresh start.

- Renting allows you the flexibility of moving from location to location without worrying about a mortgage or selling a house.

- Not sure what career path to choose? Renting keeps you flexible to adapt to changes.

- Want to get a taste of a new city before you buy a home? Renting is like a test drive.

Take my friend, for instance. He worked for years as a cityhopper.

Renting allowed him to go where he wanted without the permanence of home ownership.

2. Lower Upfront Costs

Owning a home can involve fees, inspections and beyond. Renting, on the other hand only usually requests:

- A payment of first and last month’s rent

- A security deposit

This is a fraction of the usual 20% down payment required to purchase a house. Renting can also relieve financial stress if you’re saving for other goals, like travel, retirement or launching a business.

3. No Maintenance Woes

Have a leaky roof or broken heater? That’s your landlord’s fault, not your fault.

Here’s what that could mean for you:

- No surprise repair costs

- No concerns about repairs or management

On the downside, homeownership means a continual procession of chores and costs that can snowball quickly. Renting simplified and saves you time.

4. Economic Uncertainty

The economy of 2025 is all over the map. Mortgage rates are rising and property values are all over the place. Renting may be the better financial option at the moment.

Property ties up your cash so investing it elsewhere or keeping your savings liquid is much better.

Buying Home in 2025

Certainly, there are benefits to renting. But with homeownership, you get stability, control, and the possibility to acquire long-term wealth.

Let’s look at why purchasing a home may still remain your best option.

1. Building Equity vs. Paying Rent

Paying your mortgage builds your home equity, making it a forced savings plan. Over time, this equity has several possibilities.

You can use it well in the future investments.

It can also increase when your property increases in value.

So, for instance, if you purchase a home for $300,000 and the value of your home increases to $400,000, you have an equity gain of $100,000.

If you’re renting, you don’t get that kind of financial benefit.

2. Stability and Control

Homeownership brings life stability and liberty. No rent increases, no fear of a landlord selling.

You are free in your places. Want to make your walls neon green or put a garden in the back? Do it. You are responsible for everything that happens around here.

Paying improvements, that benefit you, not a landlord.

3. Tax Benefits

There may be financial advantages to owning a home. You can deduct mortgage interest, for example.

You can also write off property taxes.

These tax breaks may help offset your costs.

They also make home ownership more affordable than you’d think.

4. Long-Term Investment

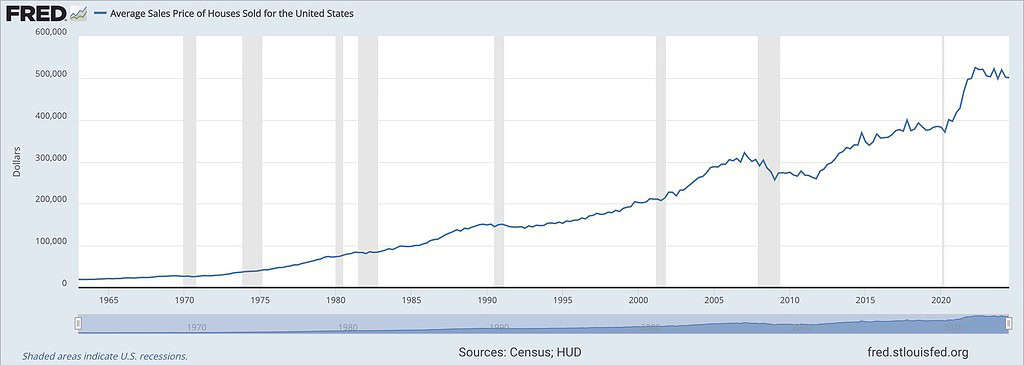

Real estate has historically been a both stable and lucrative long-term investment. Wow! Absolutely! The market can go up and down through time but typically, property values appreciate through the years.

It makes buying a home one of the smartest financial decisions you can make for multi-generational wealth building.

Is It Better to Rent or Buy a House?

Deciding whether to rent or buy depends on your own circumstances. Let us see some of the most important factors that needs to be considered:

1. Your Financial Health

You also need to have enough money saved for a down payment and closing costs.

Can you cover your monthly costs if you add a mortgage into the equation?

How is your credit score doing?

For instance, if you’re in a healthy financial situation, purchasing a house could represent a smart decision. If not, renting could offer greater flexibility and less stress.

2. Your Lifestyle Goals

- Would you be looking to settle in for 5-7 years (or longer)? If the answer is yes, purchasing a home may be a smart decision for you. It’s ideal for long-term planning.

- All you have to do is pick up and move around a bit. Your best bet may be to rent. That’s the flexibility renting gives you.

3. Market Conditions in 2025

You may want to run the numbers on a rent vs. buy calculator. These tools take into account current interest rates, rental prices and property values.

If, for example, renting would cost $2,000 a month and buying would cost $3,500, renting might be the savvy move now.

Renting vs Owning a Home: Which Is the Best Move in 2025?

Ultimately, your decision comes down to one question: What’s right for you, in this moment?

You can try our Rent vs Buy Calculator here : https://simplenewz.com/rent-vs-buy-calculator/

Here’s a summary to help you decide:

Choose Renting If:

- If you have to get up, you want it to move out of your way easily.

- You aren’t quite ready to buy a home.

- You’re pessimistic about the market or your future plans.

Choose Buying If:

You’re financially sound and looking to establish equity. You plan to be in one place for a while.

You’re ready to accept the responsibilities that come with homeownership.

Final Thoughts

The renting versus buying question has long been a hot topic, and in 2025 it’s even more layered. And renting also provides you flexibility and freedom. Home Ownership Can Provide Stability And Long-Term Asset Growth.

Consider your finances, lifestyle goals and the real estate market in your area before you decide. Deciding whether to rent or buy: Tools like rent vs. buy calculators can help you make a decision.

Ultimately, the most important thing is what fulfills you both personally and financially. Your choice. Your journey. Your life. Make it meaningful.

So, is renting or buying a house better in 2025? Whether it depends on what feels comfortable for you.