Do you ever feel like you’re drowning in expenses and not sure how to keep your head above water? You’re not alone. A shockingly high 65% of Americans have no idea how much they spent last month.

That’s wild, right?

But no worries! Enter AI budgeting apps to save the day. These nifty little tools make handling money a breeze instead of a headache.

Looking to get a grip on your finances — and perhaps actually enjoy it? Dive in with us!

Table of Contents

The Evolution of AI Budgeting Apps: Why They’re Game-Changers?

Let’s start off by talking about why AI budgeting apps are a great solution before we get into our list. Traditional budgeting can feel like a total hassle, right?. It had you typing every little thing in, tagging ad-nauseum, and hoping to remember whether you paid $5 for coffee or a sandwich.

That’s where the AI budgeting apps can step in. These not-so-average apps utilize artificial intelligence to:

- Automatically categorize your expenses

- Anticipate spending ahead of time

- Provide personalized financial advice

- Spot trends in your spending

Imagine a financial advisor that has never taken a day off in its entire life, and there is no reason for it to take a day off because it loves doing its job.

so much. Pretty cool, right?

The Top 10 AI Budgeting Apps of 2024

Now, let’s get to the good part. Here are the top 10 AI budgeting apps that revolutionizing the personal finance world:

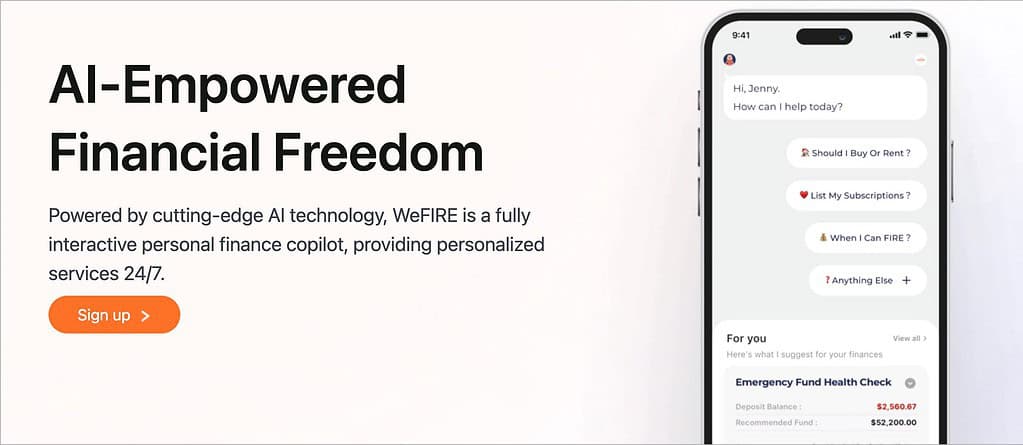

1. WeFIRE

iOS: Download

Android: Download

n App form, WeFIRE is like your super organized friend you know always has their shiz together and is always happy to lend a helping hand. It uses AI to inspect how you handle your cash and outgoings. Then it sets you specific budgets and alerts to help keep you on track.

AI Tags is extra helpful here, automatically sorting your transactions and saving you from having to worry about it.

The unique thing about WeFIRE is that we are about financial independence. It’s more than tracking spending. It’s about helping you reach those big money goals.

If you dream of retiring early, or simply want to escape the endless paycheck shuffle, WeFIRE is right there with you.

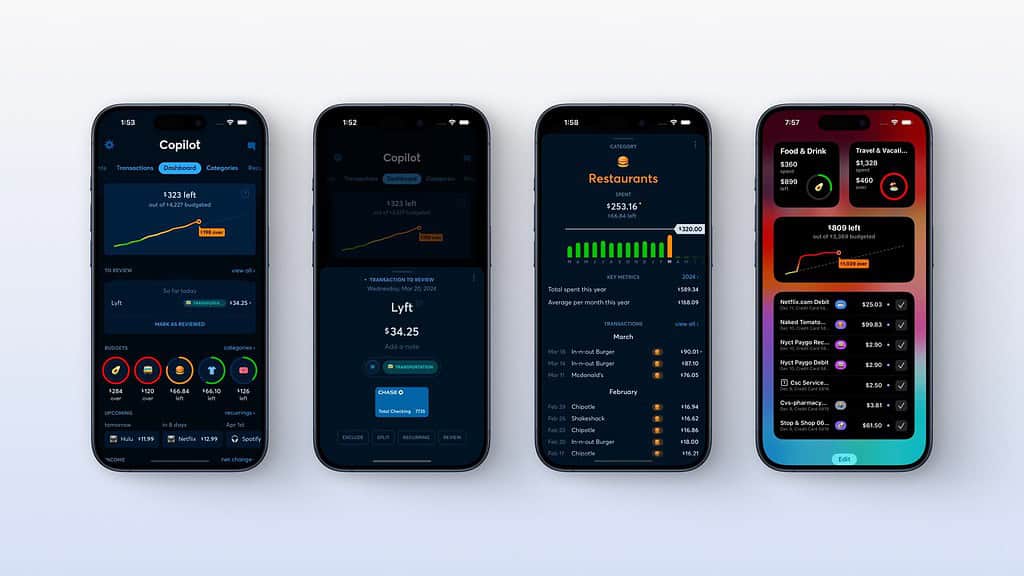

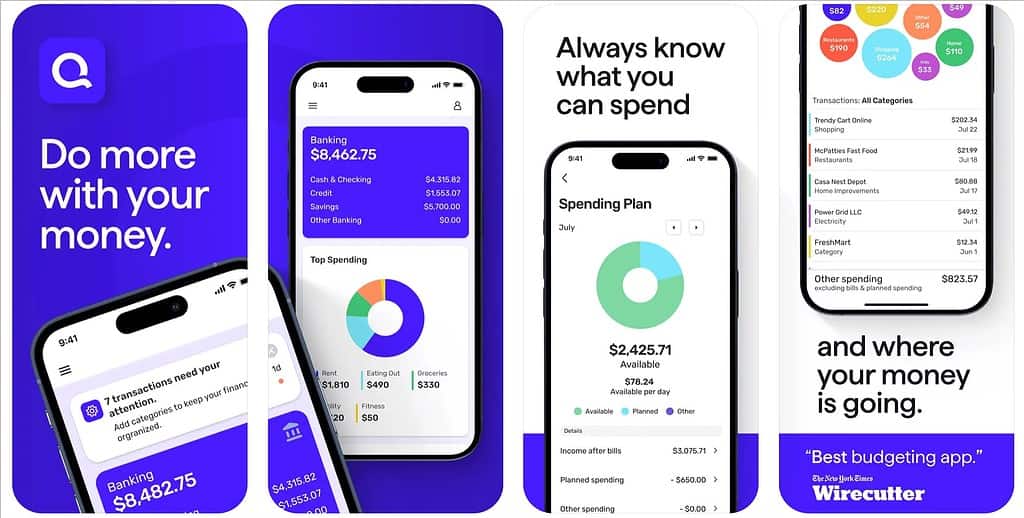

2. Copilot: Track & Budget Money

iOS: Download

Android: Download

Imagine Copilot as your very own financial sidekick with you in your pocket. This app is really smart, employing neural-network-powered artificial intelligence to categorize your spending with almost frightening accuracy. But wait, there’s more! Copilot also throws in personalized financial tips and advice relevant to you.

What really resonates with Copilot is how it gets down to the business. Rather than inundating you with data, it identifies what is important.

It’s like talking to a super smart friend who happens to work in finance.

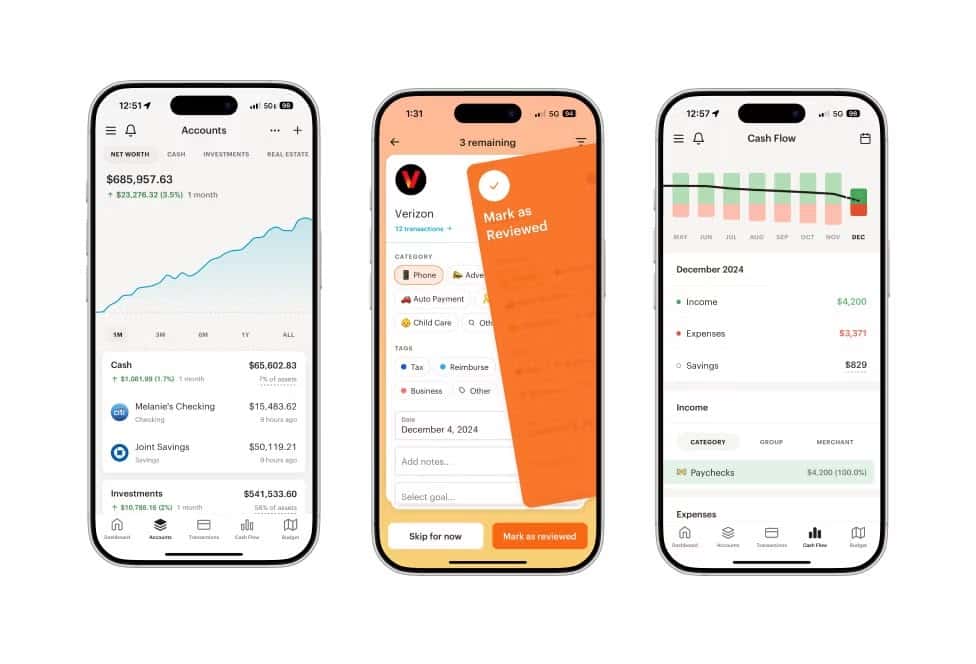

3. Monarch Money

iOS: Download

Android: Download

Monarch Money is the royal treatment for your finances. It incorporates artificially intelligence to help summarize your expenses 및 give you a helpful overview of your finances.

It is more than simply a budget plan. You can monitor investments, create goals, and view an overview of your financial universe.

What sets Monarch Money apart is its holistic approach. Saving money is more than a few dollars, it is a lifetime of savings that can help you build wealth and reach your goals.

And the app looks so good you might actually look forward to checking your finances!

4. Quicken Simplifi

iOS: Download

Android: Download

Quicken Simplifi is kind of the fun, laid-back sibling of original Quicken software. You don’t need to get an accounting degree — it’s super user-friendly, and it does what it needs to do.

It may lack the flashy AI elements found in some other apps, but it’s smart enough to make budgeting a breeze. Simplifi manages to be simple without being simplistic.

It strikes just the right balance for people who want to do more than basic expense tracking but don’t need a full suite of financial planning tools.

5. YNAB (You Need A Budget)

iOS: Download

Android: Download

The way that I think of YNAB is that it’s like that one friend that tells you the truth, even when you don’t want to hear it. It’s based on a more traditional budgeting method called envelope budgeting, but with a modern, digital twist. It may not have the most refined AI features, but it does have a few clever tools that deserve a shout out.

YNAB’s standout features are its spirited community and educational resources. More than just an app, it’s a whole new philosophy for organizing your dollars.

If you’re prepared to change how you manage your money, YNAB might just become your next best bud.

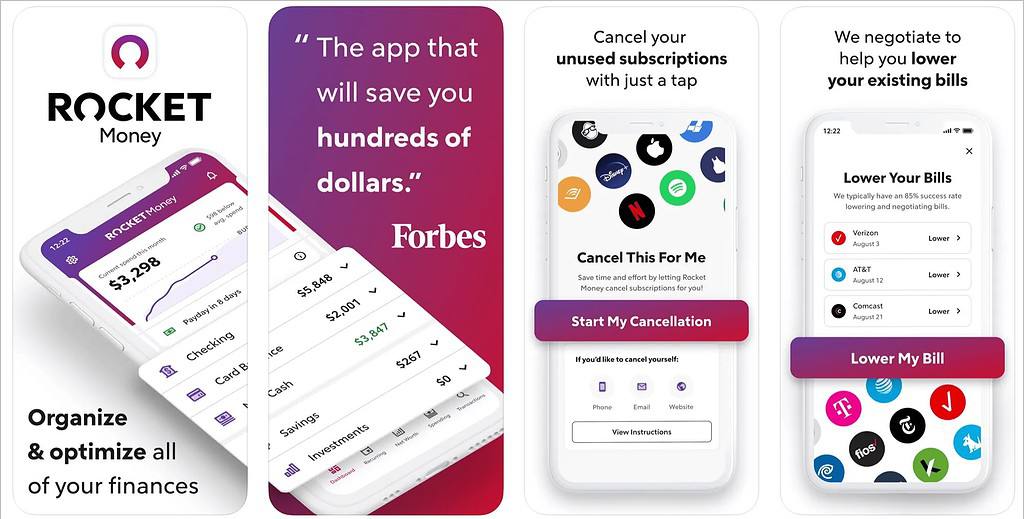

6. Rocket Money

iOS: Download

Android: Download

Rocket Money, formerly called Truebill, is your little financial detective friend. It’s great at locating those sneaky subscriptions you absolutely never remember. And it helps you cancel them. But wait, there’s more! Rocket Money also tracks your budget and negotiates your bills.

The best part? It might begin saving you money immediately. Spotting and nixing that dead weight subscription money can make Rocket Money pay for itself in no time.

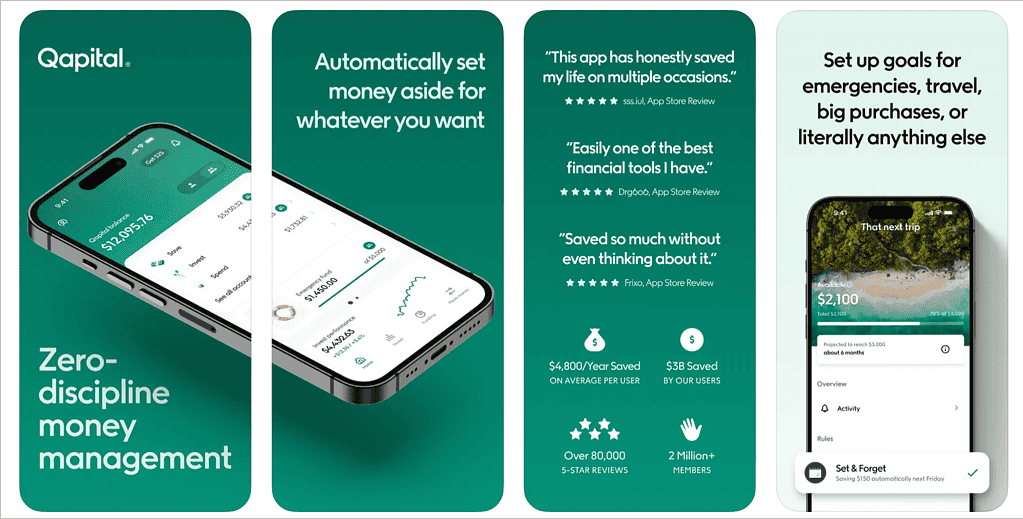

7. Qapital

iOS: Download

Android: Download

Qapital is your cool, breezy finance friend! It features gamified savings rules, automated investing, and useful learning tools.

It’s great if you’re trying to improve your financial health without the snooze-fest.

What’s really nifty about Qapital is the way it gamifies saving. You can create fun, custom rules.

For instance, consider the “Guilty Pleasure Rule” (put $5 in savings every time you order takeout) or the “52 Week Rule” (you put in $1 the first week, $2 the second week, and so on).

Qapital’s way of doing things resonates with people who think that traditional saving methods are boring or hard to maintain. And there’s more! Within the app, there are what are called “Money Missions.”

These are distinct challenges to sharpen your financial skills. View them as enjoyable and have a structure to learn financially.

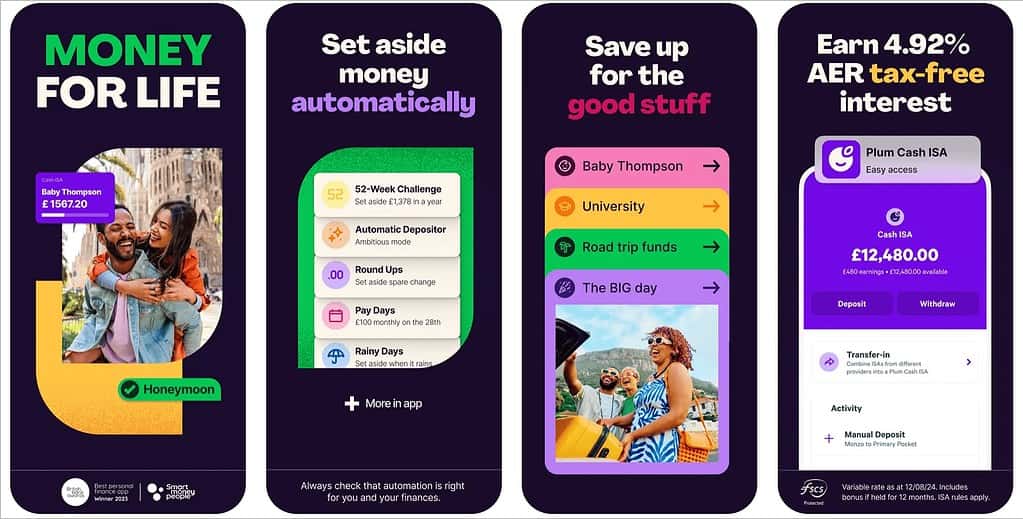

8. Plum: Smart Saving & Investing

iOS: Download

Android: Download

Plum is like your very clever mate obsessed with saving you time, energy and money.

It employs clever AI to glance at your spending habits and surreptitiously stashes away small amounts of cash you won’t even miss.

What Plum can do for you:

- Automated savings: A smart AI decides how much you can put away.

- Round-up savings: Rounding up your purchases to the nearest pound and saves the spare change.

- Bill switching: Helps you find sweeter deals on bills and utilities.

- Interest pockets: Get a small return on some of your tucked-away dollars.

Spending insights: It breaks down your spending, so you know where your dough is going.

Not so much a saving person; Plum’s here for you too. Say goodbye to those annoying manual transfers! With Plum saving’s more good habit than dry chore. Some liken the savings to “free money,” since it builds up little by little.

Plum is like a swiss army knife for better financial health and wealth building with its combination of smart savings, investing, and convenient bill-switching features.

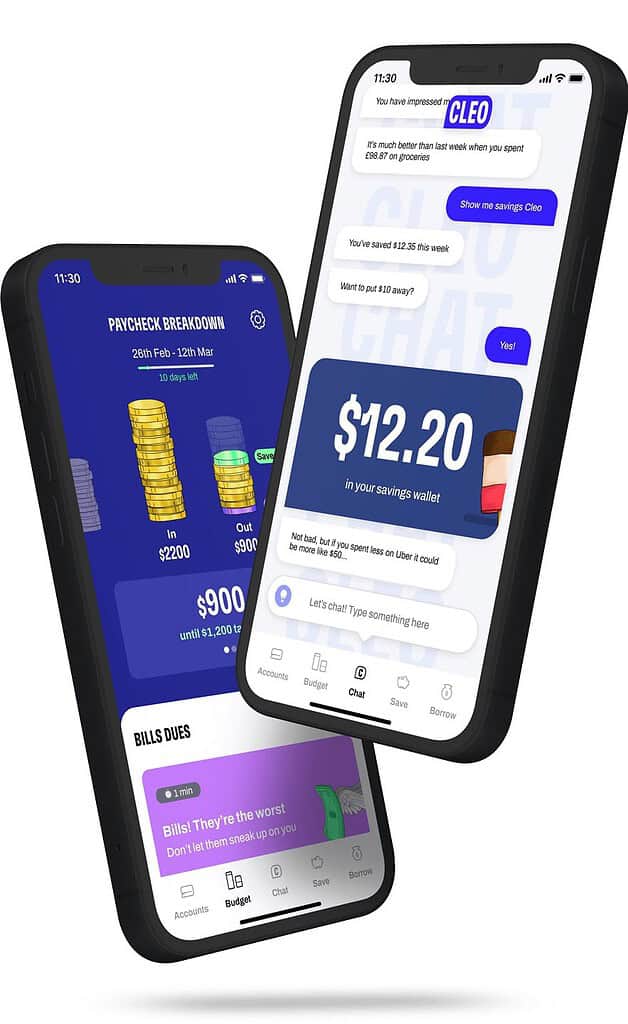

9. Cleo

iOS: Download

Android: Download

Cleo is a budget tracker powered by an AI. Imagine a sassy little financial friend in your phone. It tracks your spending and offers feedback that’s entertaining and, at times, brutally honest. Budgeting is more of a fun game and less of a headache

What makes Cleo special? It’s the personality. It talks to you via a bot who shares a love of humor, providing even cheeky “roasts” about your spending.

It’s the wake-up call many users didn’t realize they were in need of—as numerous users have shared on Reddit.

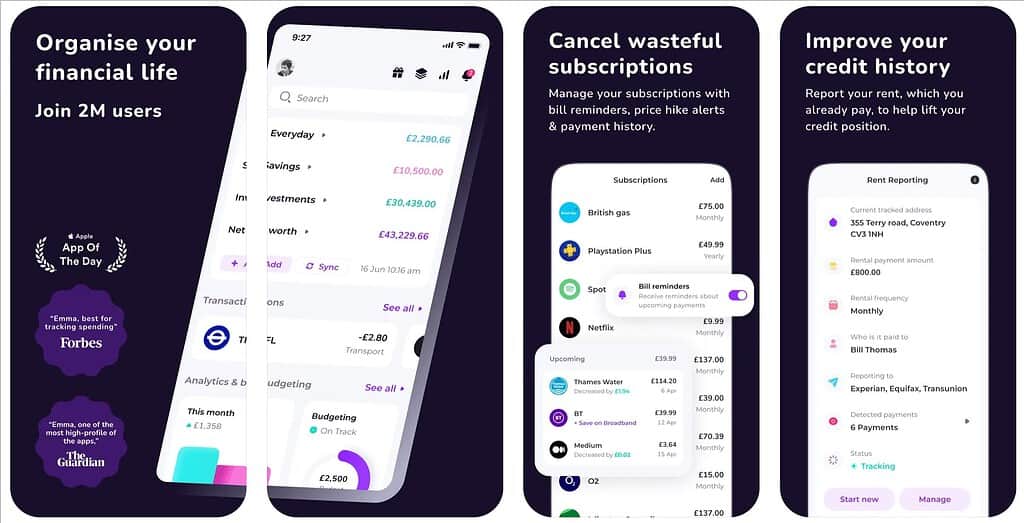

10. Emma

iOS: Download

Android: Download

Emma is like that friend you go to for financial organization. The app employs A.I. that can sort through your bank accounts, monitor your spending and provide budget-friendly advice. What makes Emma special? It’s crazy simple to use and covers every facet of money management. Everything from day-to-day to long-term investments, this app has got you covered.

Emma has been quite the sensation, with more than 1.6 million users in countries where it has rolled out. People love it for the money-saving tips and tricks. This is a game changer for anyone wanting to improve their financial health.

Emma’s all-in-one set up brings budgeting, investing and payments under one umbrella. It’s the priceless weapon for the sorts of people looking get a handle on their finances and make strategic decisions about money.

[FAQ] How to Choose the Right AI Budgeting App for You?

So, you read the list, then say, “What do I choose?” It kind of like finding that perfect pair of shoes.

What works for your friend may not work for you.

What are your financial goals?

Paying off debt? Saving for something big? Or simply putting your daily bills in order? Certain apps cater to individual users, while others take on different functions.

How tech-savvy are you?

Some apps are really intuitive and some take a little longer to learn how to use. Be honest with yourself about how long you can dedicate to learning something new.

What’s your budget for a budgeting app?

Most applications are free to use but they might charge you for certain fancy features. Consider how much you’re willing to pay to keep your finances in line (ironic where people are concerned, no?).

How do you feel about privacy?

These apps have to be connected to your financial accounts—like your bank—to function. If that bothers you, try to find apps with strong privacy protections — or go manual.

And how automated do you want things to be?

Do you prefer an app to do it all for you or do you enjoy individual control?

It’s a personal choice, and there’s no right answer: It’s about finding your own fit.

Conclusion

If you’re new to budgeting or a pro, there’s something for everyone here. The trick is finding the app that you will actually use. It’s fine to experiment with different ones until they work for you.

Your future self (and your wallet) will thank you.

Want to let A.I. help you with your finances? Grab one of these apps and start taking steps toward a more smarter financial future.

Who knows, you may find you actually enjoy managing your money.

Crazier things have happened!

So, which is your favourite of all in our best ai budget apps. Comment below.